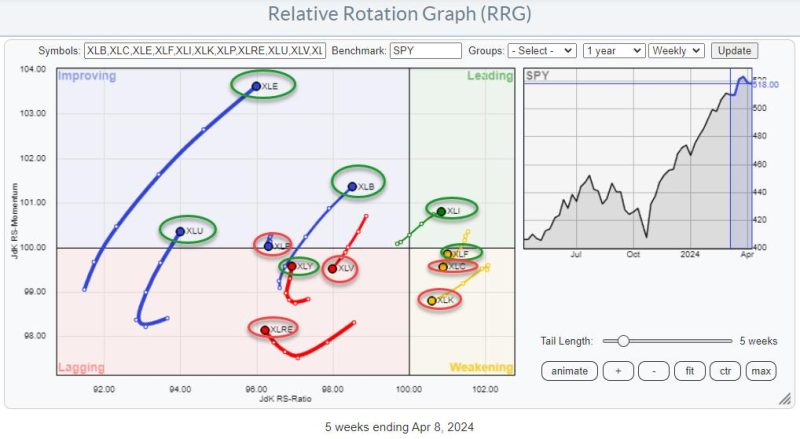

The latest report released by the Research and Rankings Group (RRG) sheds light on the progress of non-mega cap technology stocks and indicates a positive trend in their performance. This analysis marks a significant shift in the market dynamics, with smaller tech companies gaining momentum and showcasing potential for growth and stability in the coming months.

One of the key takeaways from the RRG report is the steady improvement observed in the non-mega cap technology sector. While mega-cap tech giants have long dominated the industry, smaller players are now catching up and proving their resilience in the face of market fluctuations. This shift underscores the importance of diversification and highlights the opportunities that lie beyond the well-established names in the tech industry.

The data presented in the RRG report point to a favorable outlook for non-mega cap tech stocks, with indicators suggesting a positive trajectory in the near future. This trend is attributed to a combination of factors, including innovative product offerings, strategic partnerships, and a focus on niche markets that enable these companies to differentiate themselves and carve out a unique position in the competitive landscape.

Moreover, the increasing investor interest in non-mega cap technology stocks is a testament to the growing recognition of their value and potential for long-term returns. As the market continues to evolve and adapt to changing trends, these smaller tech companies are demonstrating their ability to stay relevant and capitalize on emerging opportunities that align with consumer demands and industry developments.

In conclusion, the RRG report serves as a valuable resource for investors and industry stakeholders seeking insights into the evolving dynamics of the technology sector. The rise of non-mega cap tech stocks signals a promising shift in the market landscape, highlighting the importance of diversification and the untapped potential of companies beyond the traditional market leaders. By staying informed and attuned to these developments, investors can position themselves for success in a rapidly changing market environment.