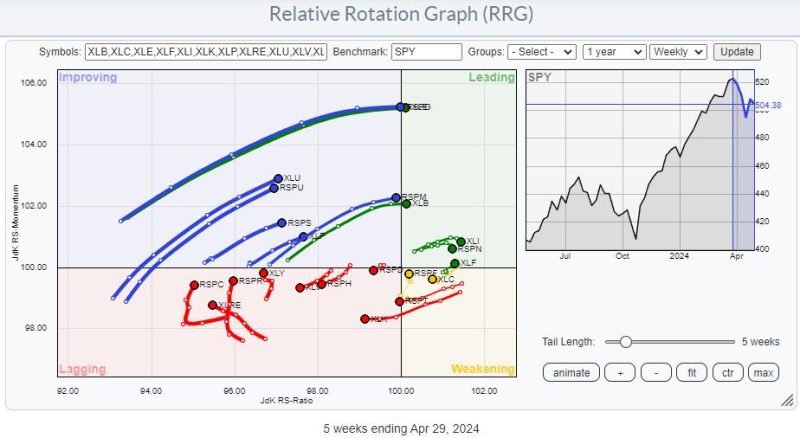

In the world of investing and trading, relative rotation graphs offer unique insights into asset performance and potential trading opportunities. As market participants seek to navigate the dynamic landscape of financial markets, the ability to identify trends and rotations can be a valuable tool in optimizing portfolio performance.

One key aspect of relative rotation graphs is the concept of diverging tails, which can signal significant shifts in relative strength among different assets or sectors. By understanding and interpreting these diverging tails, traders and investors can gain a deeper understanding of market dynamics and make informed decisions about asset allocation and trades.

When analyzing a relative rotation graph, it is essential to pay close attention to the direction and magnitude of the tails. Diverging tails occur when two assets or sectors are moving in opposite directions, indicating a clear divergence in performance. This can be a powerful signal for traders, as it highlights opportunities to capitalize on potentially mispriced assets or sectors.

For example, if one tail is sharply moving upward while the other is declining, it suggests that one asset or sector is gaining strength relative to the other. This could indicate a shift in market sentiment or a change in underlying fundamentals that traders can exploit for profit.

By actively monitoring relative rotation graphs for diverging tails, traders can stay ahead of market trends and position themselves to take advantage of emerging opportunities. This proactive approach to market analysis allows traders to adapt quickly to changing conditions and maximize their returns in both bull and bear markets.

In conclusion, relative rotation graphs offer a unique perspective on asset performance and rotation trends in financial markets. Diverging tails on these graphs can provide valuable insights into potential trading opportunities by highlighting shifts in relative strength among assets or sectors. By leveraging this information effectively, traders can make more informed decisions and optimize their portfolio performance.