In a world filled with uncertainties, the realm of investing often stands as a beacon of hope for achieving financial stability and growth. The stock market, in particular, has long been a favored avenue for individuals looking to grow their wealth over the long term. With its dynamic nature, the stock market presents a myriad of opportunities and challenges for investors seeking to navigate its intricate landscape.

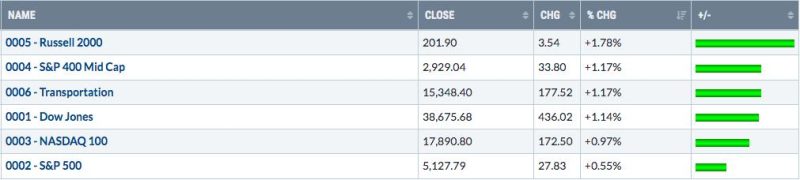

Investing in U.S. stocks has gained prominence as a popular choice among investors due to the country’s robust economy, technological advancements, and global influence. The U.S. stock market, represented by major indices such as the S&P 500 and the Dow Jones Industrial Average, has produced significant returns over the years, attracting both domestic and international investors seeking exposure to diverse sectors and industries.

One key aspect to consider when investing in U.S. stocks for the long term is to adopt a strategic approach that aligns with one’s financial goals and risk tolerance. Diversification, a fundamental principle in investing, plays a crucial role in mitigating risk and maximizing returns over an extended period. By spreading investments across various asset classes, industries, and geographies, investors can reduce the impact of market volatility and potential downturns on their overall portfolio.

Moreover, maintaining a long-term perspective is essential for weathering the inevitable ups and downs of the stock market. While short-term fluctuations may be unsettling, focusing on the underlying fundamentals of the companies in which one invests can provide a sense of stability and confidence in the long run. Companies with strong financials, competitive advantages, and growth potential are more likely to endure market volatility and deliver sustainable returns over time.

Another consideration for investors looking to build a long-term U.S. stock portfolio is to stay informed about macroeconomic trends, geopolitical events, and regulatory changes that may impact the market. Keeping abreast of relevant news and developments can help investors make informed decisions about their holdings and adjust their strategies accordingly to capitalize on emerging opportunities or mitigate potential risks.

In conclusion, investing in U.S. stocks for the long term can be a rewarding endeavor for individuals seeking to build wealth and achieve financial independence. By adopting a strategic approach, diversifying their portfolios, maintaining a long-term perspective, and staying informed about market dynamics, investors can position themselves for success in the dynamic world of stock market investing.