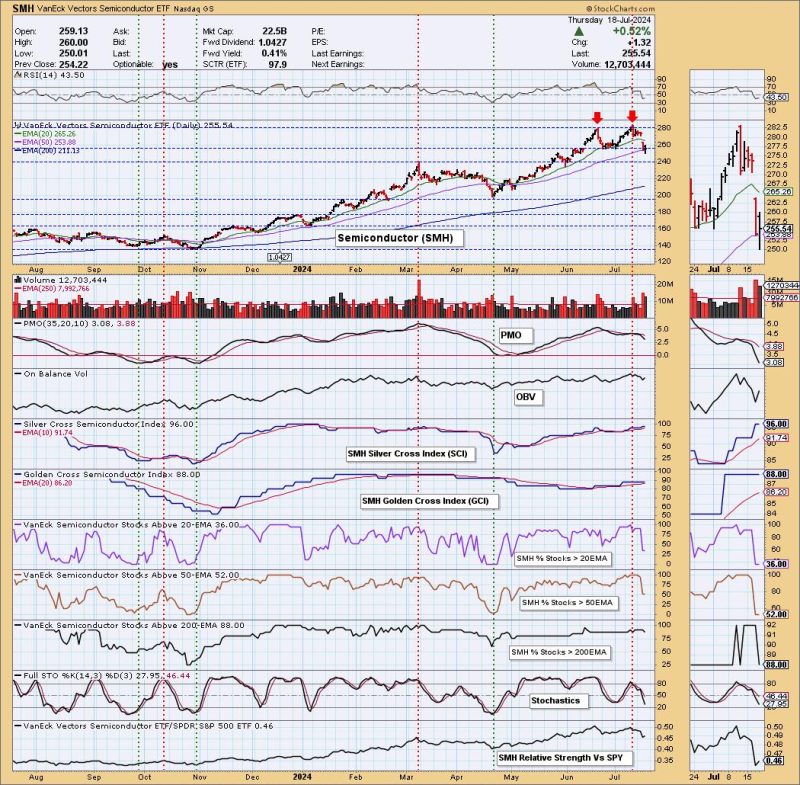

The article presents a detailed analysis of the double top pattern observed on the Semiconductors ETF (SMH) chart. This technical pattern is often regarded as a bearish signal in technical analysis, indicating a potential trend reversal in the market. Traders and investors pay close attention to such patterns as they provide valuable insights into potential market movements.

The double top pattern is characterized by two peaks at relatively the same level, separated by a trough in between. In the case of SMH, this pattern indicates a level where the price has faced resistance twice, forming a strong barrier preventing further upward movement. This resistance level is crucial as it represents a point where bears outnumber bulls, leading to a possible reversal.

Analyzing the price action around the double top pattern is essential for determining the strength of the signal. Traders often look for confirmation through other technical indicators, volume analysis, and market sentiment. A break below the support level, which corresponds to the trough between the two peaks, typically confirms the validity of the double top pattern and signals a potential downtrend.

Moreover, the timeframe in which the pattern appears also plays a significant role in its reliability. Patterns observed on longer timeframes are considered more potent and likely to have a stronger impact on price movements compared to patterns on shorter timeframes. Therefore, the double top pattern on SMH’s chart, being significant, raises concerns about the potential reversal of the uptrend in the semiconductor sector.

Additionally, traders incorporate risk management strategies when trading based on technical patterns like the double top. Setting stop-loss orders, monitoring key support and resistance levels, and practicing proper position sizing are crucial aspects of risk management in trading. By implementing these strategies, traders can protect their capital and manage potential losses when executing trades based on technical patterns.

In conclusion, the double top pattern observed on the Semiconductors ETF (SMH) chart signals a potential trend reversal and demands attention from traders and investors. Understanding the characteristics of this pattern, analyzing price action, seeking confirmation from other indicators, and implementing effective risk management are essential steps in capitalizing on trading opportunities presented by technical patterns. Keeping a close eye on market developments and responding strategically to changing trends can help traders navigate the dynamic landscape of financial markets successfully.