The 1-2-3 Reversal Pattern: A Powerful Tool in Trading

Understanding the intricacies of technical analysis in trading can lead to better-informed decisions and increased profitability. One such pattern that traders often utilize is the 1-2-3 reversal pattern. This pattern is based on the concept of trend reversal and can be a valuable asset in a trader’s toolkit.

**What is the 1-2-3 Reversal Pattern?**

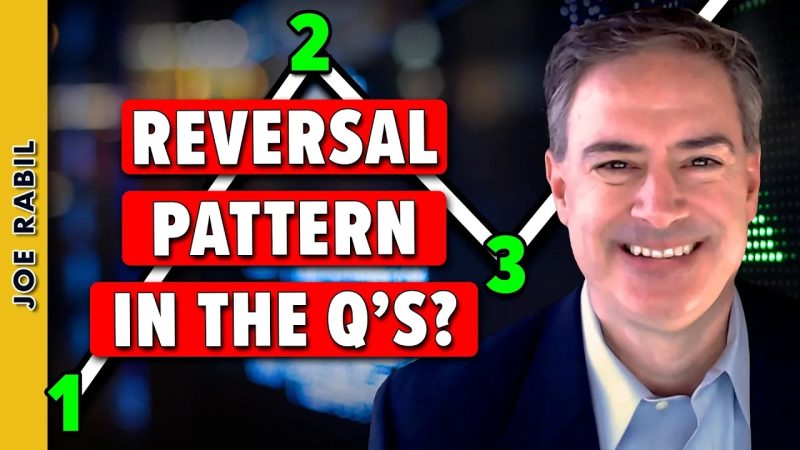

The 1-2-3 reversal pattern is a chart pattern that signifies a potential trend reversal in the market. It consists of three distinct price moves – the initial trend, the retracement, and the new trend direction. The pattern is formed when the price makes a new high or low, then retraces, and finally breaks past the initial high or low, indicating a reversal in the prevailing trend.

**How to Identify the 1-2-3 Reversal Pattern**

Identifying the 1-2-3 reversal pattern involves keen observation of price action on a chart. The first step is to identify a clear trend, followed by a retracement that does not breach the previous high or low. The final step is the formation of a new high or low that surpasses the initial point, confirming the reversal pattern.

**Trading with the 1-2-3 Reversal Pattern**

Trading with the 1-2-3 reversal pattern requires a disciplined approach and adherence to risk management principles. Once the pattern is confirmed, traders can enter a position in the direction of the new trend, setting stop-loss orders to limit potential losses. Profit targets can be set based on the size of the pattern, providing a clear exit strategy.

**Key Considerations When Using the 1-2-3 Reversal Pattern**

While the 1-2-3 reversal pattern can be a powerful tool, it is essential to consider some key factors when implementing it in trading:

1. Confirmation: Wait for the pattern to be fully formed and confirmed before entering a trade to reduce false signals.

2. Risk Management: Set appropriate stop-loss orders to manage risk and protect capital.

3. Timeframes: The pattern can be applied to various timeframes, so consider the trading horizon and adjust strategies accordingly.

4. Price Action: Pay attention to supporting factors such as volume and other technical indicators to validate the pattern.

In conclusion, the 1-2-3 reversal pattern is a valuable concept in technical analysis that can assist traders in identifying potential trend reversals and making informed trading decisions. By understanding how to identify and trade this pattern effectively, traders can enhance their trading strategies and improve their overall performance in the market.