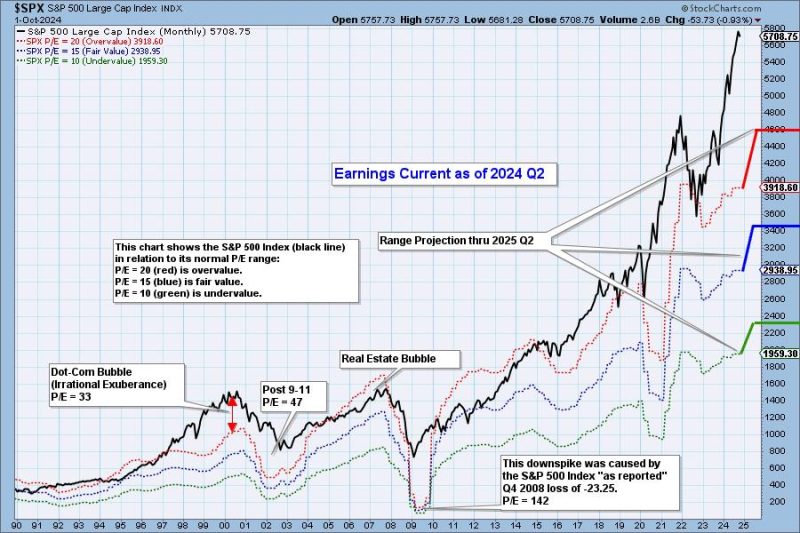

With the release of the second quarter earnings in 2024, the stock market continues to show signs of being very overvalued. Investors and analysts alike have been closely watching the market’s performance, hoping for some indication of a potential correction or adjustment in valuations.

One of the key drivers of the market’s overvaluation is the sustained growth in technology stocks. Companies in the tech sector have continued to deliver strong financial results, driven by innovative products and services that cater to the changing needs of consumers. This growth has led to increased investor interest and high valuations for tech stocks, pushing the overall market valuation higher.

Another factor contributing to the market’s overvaluation is the low interest rate environment. With central banks keeping rates at historically low levels to stimulate economic growth, investors have been turning to equities as a way to generate higher returns. This influx of capital into the stock market has fueled the rally and pushed valuations to lofty levels.

Furthermore, the market’s overvaluation can also be attributed to the abundance of liquidity in the financial system. With easy access to credit and ample liquidity in the market, investors have been able to leverage their positions and drive up asset prices. This has created a situation where many assets, including stocks, are trading at levels that may not be supported by underlying fundamentals.

Despite these concerns, some investors remain optimistic about the market’s future. They point to strong corporate earnings, robust economic growth, and ongoing technological advancements as reasons to believe that valuations are justified. Additionally, the prospect of continued fiscal and monetary support from governments and central banks provides further reassurance to those who are bullish on the market.

In conclusion, while the market may be currently overvalued, investors should remain cautious and vigilant in their investment decisions. It is essential to conduct thorough research, diversify portfolios, and be prepared for potential market corrections or volatility. By staying informed and prudent in their investment approach, investors can navigate the challenges posed by an overvalued market and position themselves for long-term success.