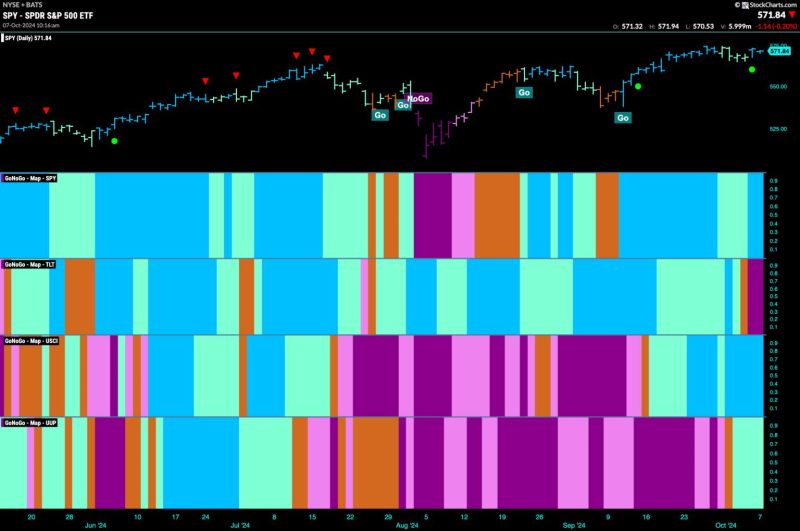

Equities Remain in ‘Go’ Trend and Lean into Energy

The equity market continues its upward momentum as the ‘Go’ trend persists amid the ongoing economic recovery. Investors are taking advantage of this bullish sentiment to strategically position themselves within promising sectors, with a particular focus on the energy industry. Recent market movements reflect a growing appetite for energy stocks, driven by various factors that are shaping the sector’s outlook in the coming months.

One key driver of the increased interest in energy stocks is the global push towards renewable energy sources. As the world transitions towards cleaner and more sustainable energy alternatives, traditional energy companies are adapting their business models to stay relevant in a changing market landscape. This shift has prompted investors to reconsider their stance on energy stocks, recognizing the long-term potential in companies that are embracing renewable energy initiatives.

Furthermore, the recent surge in commodity prices has boosted the performance of energy companies, adding to their appeal for investors seeking exposure to sectors with strong growth prospects. The rebound in oil prices, coupled with increasing demand for natural gas and other energy resources, has created a conducive environment for energy stocks to thrive, driving up both stock prices and market sentiment.

Moreover, the ongoing geopolitical developments and supply chain disruptions have contributed to the volatility in energy markets, presenting both challenges and opportunities for investors. The uncertainty surrounding global energy supply, along with shifting consumption patterns, has opened up avenues for shrewd investors to capitalize on market inefficiencies and identify undervalued energy assets.

In light of these factors, investors are advised to adopt a diversified approach when considering energy stocks, taking into account the volatility and inherent risks associated with the sector. By combining traditional energy plays with exposure to renewable energy companies and emerging technologies, investors can mitigate risk while maximizing their potential returns in an evolving market environment.

Overall, the ‘Go’ trend in equities provides a favorable backdrop for investors looking to capitalize on the growth potential within the energy sector. By staying informed about market developments, maintaining a balanced portfolio, and seizing opportunities as they arise, investors can position themselves for success in a dynamic and ever-changing market landscape.