As the trading week approaches, investors and traders in the Nifty index are gearing up for potential market movements. Analyzing the current market environment can help in better decision-making and devising effective trading strategies. The week ahead for the Nifty index may see a range-bound pattern, but trending moves could occur if certain price levels are breached.

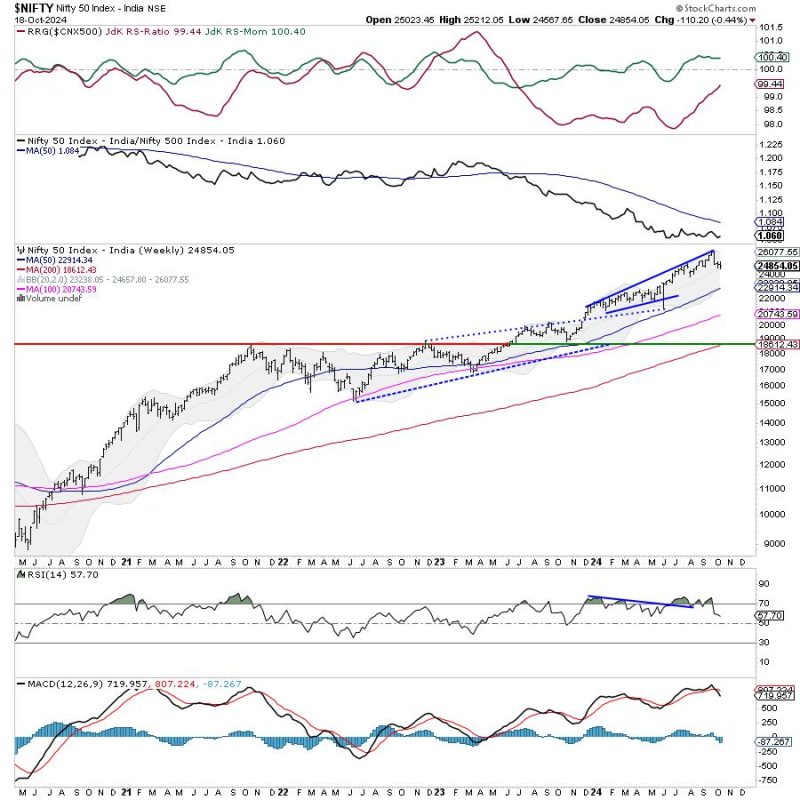

Technical analysis plays a crucial role in predicting potential market movements. By examining key levels and indicators, traders can identify important support and resistance levels that may influence the direction of the index. The Nifty index has the potential to stay within a specific range during the upcoming week, but a breakout above or below these ranges could signify a change in market sentiment.

One essential aspect to watch closely is the support and resistance levels for the Nifty index. These levels act as barriers that could either contain the price within a range or lead to a breakout. Traders should pay attention to these levels as breaching them could trigger trending moves in either direction.

Moreover, volume analysis can provide valuable insights into the strength and momentum of a price movement. A surge in trading volume accompanying a breakout above a resistance level or below a support level could indicate a strong directional move. Traders should monitor volume patterns to confirm the validity of a breakout and assess the potential follow-through.

Market sentiment and external factors can also impact the Nifty index’s movements. Traders should stay informed about economic data releases, corporate announcements, and geopolitical events that could influence market dynamics. Being aware of these factors can help traders anticipate potential market reactions and adjust their trading strategies accordingly.

Risk management is crucial when trading in volatile markets like the Nifty index. Setting stop-loss orders and adhering to risk management principles can help protect capital and minimize losses in case of unfavorable market movements. Traders should also consider diversifying their portfolios and avoiding placing all their eggs in one basket to spread risk effectively.

In conclusion, the week ahead for the Nifty index presents opportunities for traders to navigate potential market movements effectively. By analyzing key support and resistance levels, monitoring volume patterns, staying informed about market dynamics, and implementing robust risk management strategies, traders can position themselves to capitalize on trending moves and protect their capital in uncertain market conditions. Maintaining discipline, patience, and a well-thought-out trading plan can help traders navigate the market with confidence and achieve their trading goals.