Secular Bull Market Continues but with Major Rotation

The global market has been experiencing a secular bull market, with investors enjoying significant returns on their investments. However, recent shifts in the market have prompted a major rotation in sectors that have been leading the way.

Traditional tech giants such as Apple, Microsoft, and Amazon have long been the darlings of the market, driving growth and innovation in the technology sector. These companies have been at the forefront of the digital revolution, capturing market share and investor interest along the way.

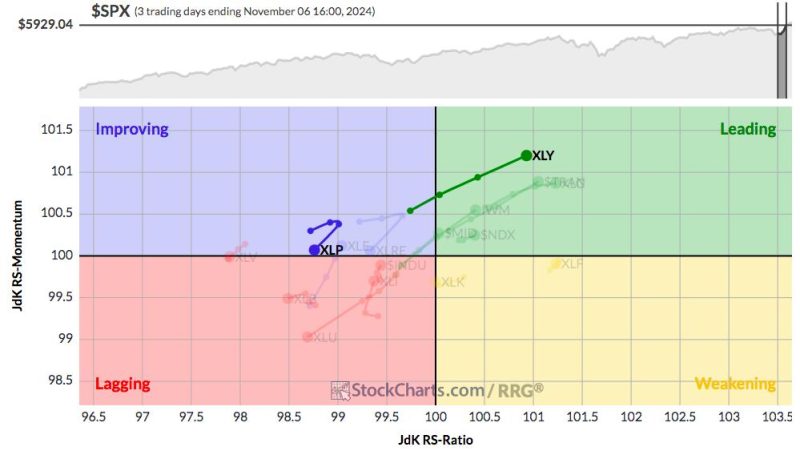

However, in recent months, a shift has been observed as investors have started to pivot away from these tech giants towards other sectors such as healthcare, consumer staples, and energy. This major rotation suggests a changing sentiment in the market, with investors looking for new opportunities beyond the traditional tech sector.

One of the key drivers of this rotation is the increasing focus on sustainability and environmental responsibility. Companies in sectors such as renewable energy, electric vehicles, and sustainable agriculture have been gaining traction as investors prioritize companies that are aligned with their values and contribute positively to the planet.

Additionally, the COVID-19 pandemic has highlighted the importance of healthcare and pharmaceutical companies in ensuring global health and well-being. As the world grapples with the ongoing challenges posed by the pandemic, investors are turning their attention towards companies that are at the forefront of healthcare innovation and solutions.

Consumer staples have also seen increased interest from investors as consumers continue to prioritize essential goods and products. Companies in sectors such as food and beverage, household products, and personal care are benefiting from this shift in consumer behavior, driving growth and stability in their respective markets.

Furthermore, the energy sector has seen a resurgence as global demand for clean and sustainable energy sources continues to grow. Companies involved in renewable energy, natural gas, and electric utilities are well-positioned to capitalize on this trend, attracting the attention of investors who are looking for opportunities in the energy transition.

In conclusion, while the secular bull market continues to thrive, the recent major rotation in sectors indicates a changing investment landscape. Investors are diversifying their portfolios and exploring new opportunities beyond the traditional tech giants, focusing on sectors such as healthcare, consumer staples, and energy that offer growth potential and align with their values. As the market continues to evolve, staying informed and adapting to these shifts will be essential for investors to navigate the ever-changing investment landscape successfully.