The US dollar has been a focal point for traders and investors around the globe due to its status as the world’s primary reserve currency. Recent analysis suggests that the USD might be setting up for a significant rally, which could have far-reaching implications across financial markets.

One key factor supporting the potential for a USD rally is the outlook for the US economy. Despite facing challenges such as inflationary pressures and supply chain disruptions, the US economy has shown resilience and continues to recover from the impact of the COVID-19 pandemic. Strong economic data, including robust job growth and increasing consumer spending, indicate that the US economy is on a solid footing.

Another factor that could fuel a USD rally is the Federal Reserve’s monetary policy stance. The Fed has started tapering its asset purchases and is signaling a gradual tightening of monetary policy to combat rising inflation. This hawkish stance could provide support for the USD as higher interest rates make dollar-denominated assets more attractive to investors.

Geopolitical tensions and uncertainties also play a significant role in shaping the USD’s outlook. With ongoing conflicts and diplomatic challenges around the world, investors often turn to safe-haven assets like the US dollar during times of uncertainty. Any escalation in geopolitical tensions could lead to a flight to safety, benefiting the USD.

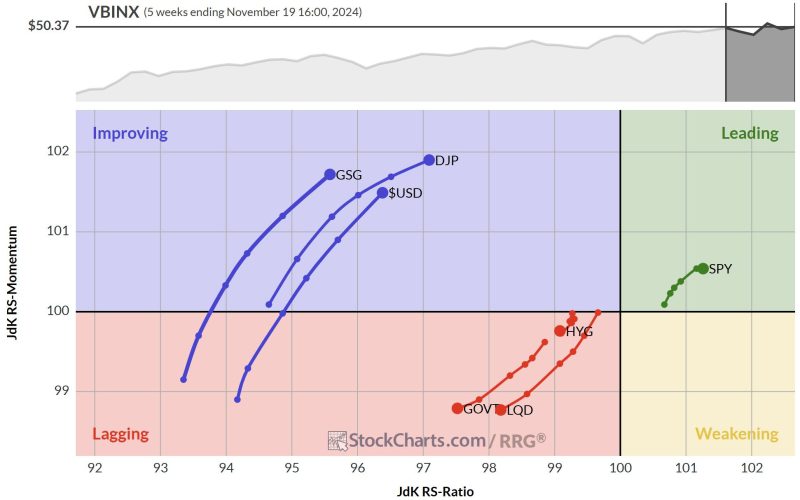

Technical analysis of the USD also points towards a potential rally. The USD index has shown signs of bottoming out and forming a base, which could pave the way for a sustained uptrend. Key levels and chart patterns suggest that the USD may be gearing up for a breakout, attracting more buyers and driving its value higher.

While there are several factors pointing towards a USD rally, it is essential to monitor developments closely and consider the broader market context. Market sentiment, economic data releases, central bank decisions, and geopolitical events can all influence the USD’s trajectory. Traders and investors should stay informed and adapt their strategies accordingly to navigate the dynamic landscape of the foreign exchange market.

In conclusion, the potential for a USD rally presents opportunities and risks for market participants. By staying informed, conducting thorough analysis, and managing risk effectively, traders and investors can position themselves to capitalize on potential movements in the USD and other related assets.