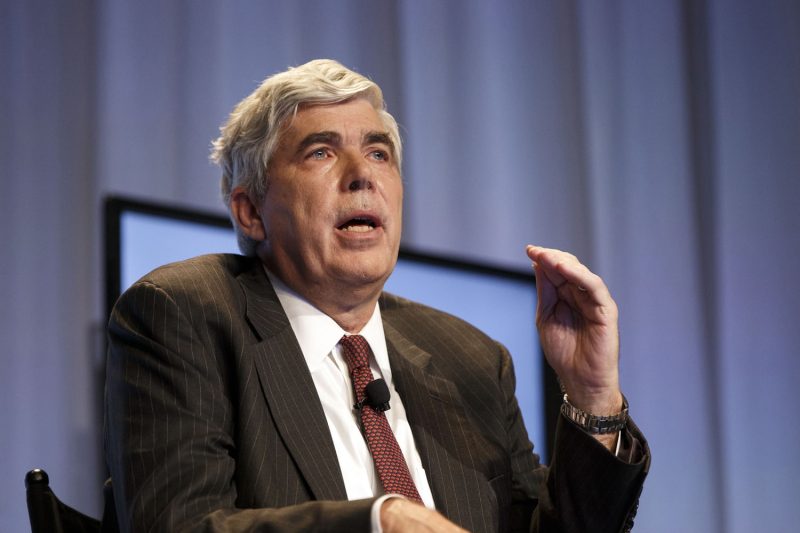

U.S. Charges Former Wamco Executive Kenneth Leech with Fraud

The recent indictment of former Wamco executive Kenneth Leech on charges of wire fraud and money laundering has sent shockwaves through the financial industry. The allegations against Leech, a once-respected figure in the world of investments, have raised serious concerns about the integrity of the market and the individuals entrusted with managing vast sums of money.

According to the U.S. Department of Justice, Leech is accused of orchestrating a complex scheme to defraud investors and enrich himself at their expense. Prosecutors allege that Leech used his position of authority at Wamco to misappropriate funds and engage in fraudulent transactions, ultimately causing substantial financial harm to unsuspecting clients.

The details of the charges outline a troubling pattern of deceit and manipulation. Leech allegedly misled investors about the nature of their investments, promising high returns while secretly diverting funds for personal gain. Furthermore, the indictment alleges that Leech fabricated financial documents to obscure his illicit activities and deceive regulators and auditors.

The fallout from these allegations is likely to be far-reaching. The case against Leech highlights the critical importance of transparency and accountability in the financial sector. Investors place their trust in professionals like Leech to act in their best interests and safeguard their assets. When that trust is betrayed, the consequences can be devastating.

This incident also underscores the need for robust oversight and regulation to prevent fraud and misconduct in the financial industry. Authorities must remain vigilant and proactive in identifying and prosecuting individuals who abuse their positions of power for personal gain. By holding individuals like Leech accountable for their actions, we can help restore confidence in the integrity of the market and protect investors from future harm.

As the case against Kenneth Leech unfolds, it serves as a stark reminder of the risks inherent in the world of finance. Investors must exercise caution and due diligence when entrusting their money to others, and regulators must remain vigilant in their efforts to identify and prosecute fraudulent activity. Only through a collective commitment to transparency and accountability can we ensure the long-term stability and credibility of the financial industry.