Silver Cross Buy Signals on the DOW, DIA, and Russell 2000 ETF (IWM)

In the world of investing, technical analysis is a crucial tool that many traders use to make informed decisions about market trends. One popular technical indicator that traders look out for is the Silver Cross Buy Signal. This signal occurs when the short-term moving average of an index or stock crosses above its long-term moving average, indicating a potential bullish trend. Recently, the DOW, DIA, and Russell 2000 ETF (IWM) have all exhibited Silver Cross Buy Signals, prompting investors to take notice and consider their next moves.

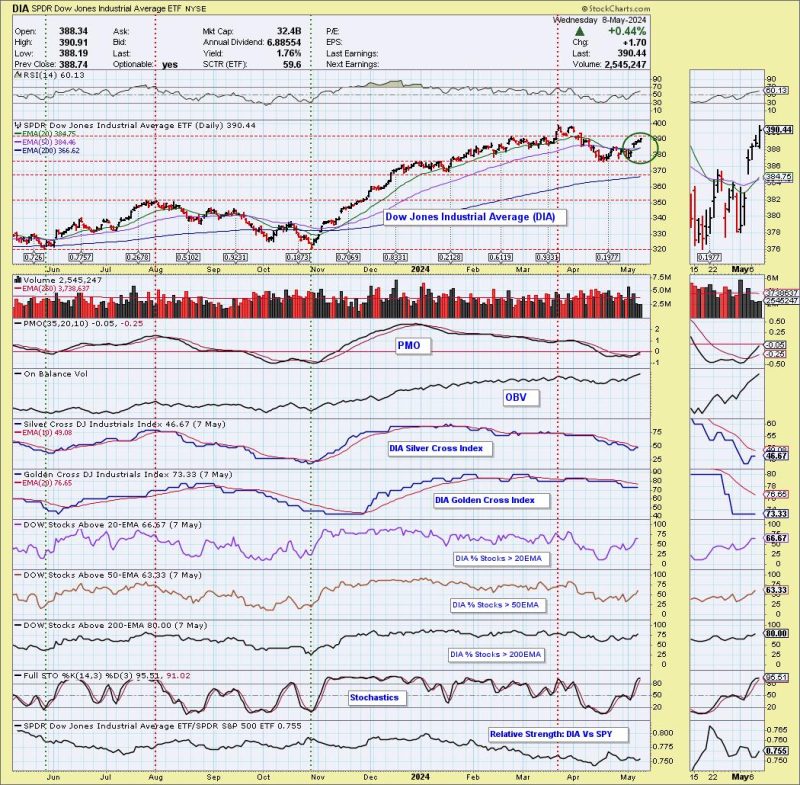

The DOW Jones Industrial Average (DOW) is one of the most widely followed stock market indexes in the world, tracking 30 large-cap companies listed on U.S. stock exchanges. The DOW recently experienced a Silver Cross Buy Signal when its 50-day moving average crossed above its 200-day moving average. This signal is often seen as a positive sign for the market as it suggests that the recent uptrend in the index may continue in the short to medium term.

Similarly, the SPDR Dow Jones Industrial Average ETF (DIA), which tracks the performance of the DOW, also exhibited a Silver Cross Buy Signal around the same time. The DIA is a popular choice for investors looking to gain exposure to the DOW without having to buy individual stocks. The signal on the DIA further reinforces the bullish sentiment surrounding the DOW and indicates that investors may continue to see positive returns in the near future.

On the other hand, the Russell 2000 ETF (IWM) tracks the performance of small-cap companies in the U.S. stock market. Small-cap stocks are often seen as more volatile than large-cap stocks, but they can also offer significant growth opportunities. Recently, the IWM generated a Silver Cross Buy Signal, indicating that small-cap stocks may be poised for a bullish run. This signal could be particularly encouraging for investors looking to diversify their portfolios and capitalize on the potential growth of smaller companies.

While the Silver Cross Buy Signals on the DOW, DIA, and Russell 2000 ETF (IWM) are certainly positive indicators, it is important for investors to conduct thorough research and consider other factors before making investment decisions. Market conditions can change quickly, and it is essential to stay informed and be prepared for any potential shifts in the market.

In conclusion, the recent Silver Cross Buy Signals on the DOW, DIA, and Russell 2000 ETF (IWM) are encouraging signs for investors looking to capitalize on potential bullish trends in the stock market. By staying informed and conducting thorough analysis, investors can position themselves to make well-informed decisions and navigate the market with confidence.