In the fast-paced world of investing, keeping an eye on market dynamics plays a crucial role in making sound financial decisions. With markets constantly evolving, it’s essential for investors to stay updated on the latest trends and indicators to navigate through the ever-changing landscape effectively.

One noticeable trend that has caught the attention of many investors is the term toppy market. This refers to a market that appears to be reaching its peak, signaling a potential downturn or correction in the near future. Identifying a toppy market is essential for investors looking to protect their investments and adjust their strategies accordingly.

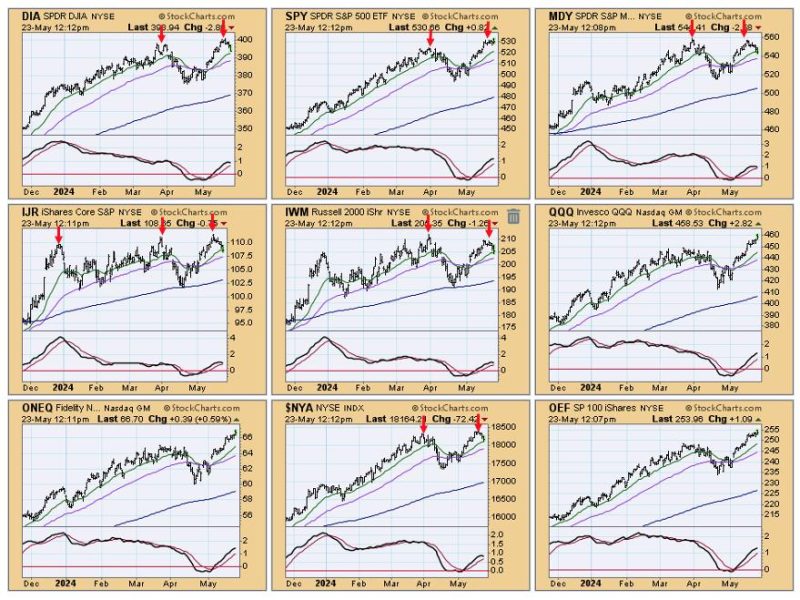

Several key indicators can help investors assess whether the market is indeed toppy. One common signal is when stock prices reach all-time highs, often fueled by excessive optimism and speculative buying. While reaching new highs can be a positive sign of a healthy market, it can also indicate an overheated market that may be due for a pullback.

Another indicator of a toppy market is an elevated level of market volatility. Increased volatility can suggest that investor sentiment is becoming more uncertain, potentially leading to abrupt market movements and heightened risk. Monitoring volatility through indicators such as the VIX can provide valuable insights into market sentiment and stability.

Additionally, valuation metrics such as price-to-earnings (P/E) ratios can offer valuable insights into whether a market is overvalued. High P/E ratios relative to historical averages may indicate that stocks are expensive and could be vulnerable to a correction.

It’s important for investors to exercise caution when navigating a toppy market. Implementing risk management strategies such as diversification, setting stop-loss orders, and scaling back on high-risk investments can help mitigate potential losses when market conditions are uncertain.

While a toppy market may present challenges, it also offers opportunities for savvy investors. By remaining vigilant, staying informed, and adapting their strategies to changing market conditions, investors can position themselves to weather market downturns and capitalize on new opportunities that arise.

In conclusion, recognizing the signs of a toppy market is crucial for investors looking to protect their investments and make informed decisions. By monitoring key indicators, exercising caution, and implementing risk management strategies, investors can navigate through uncertain market conditions with confidence and resilience.