The Hindenburg Omen: Decoding the Stock Market’s Mysterious Signal

What is the Hindenburg Omen?

The Hindenburg Omen is a technical indicator that attempts to predict stock market crashes by analyzing a set of conditions within market data. This indicator is named after the German airship Hindenburg, which famously crashed and burned in 1937. The omen was first described by the creator, James R. Miekka, and has since garnered attention among traders and investors worldwide.

How Does It Work?

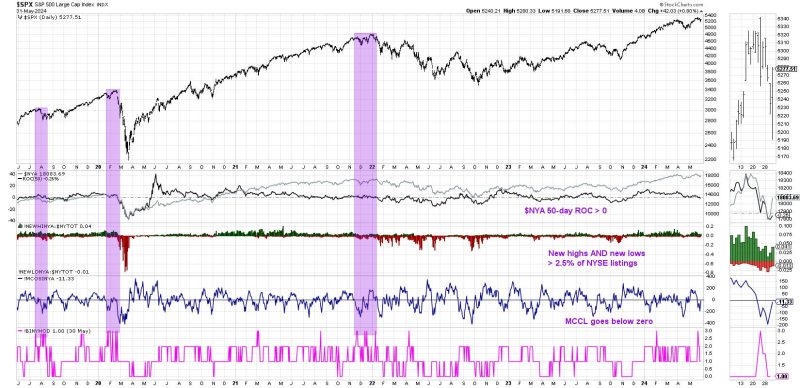

The Hindenburg Omen is primarily based on four criteria that need to be met for the signal to be triggered. These criteria include a rising 10-week moving average, a new 52-week high, a negative McClellan Oscillator, and a high number of both advancing and declining stocks. When these conditions align, it is believed to foretell an impending market downturn.

Interpreting the Omen

While the Hindenburg Omen has been associated with significant market declines in the past, it is important to note that not every signal results in a crash. Some market analysts argue that the signal may be more of a statistical anomaly rather than a reliable predictor of future market movements. Nevertheless, many traders pay close attention to the omen as a potential warning sign of increased market volatility.

Historical Context

The Hindenburg Omen gained widespread attention during major market downturns, such as the 2008 financial crisis. However, it is worth noting that the indicator has also produced false alarms in the past, leading to skepticism among some experts. As with any technical indicator, it is crucial to consider multiple factors and not rely solely on one signal for investment decisions.

The Debate Continues

The debate surrounding the Hindenburg Omen’s effectiveness as a market predictor continues among traders and analysts. While some view it as a valuable tool for identifying market risk, others are more cautious about its reliability. As the stock market remains unpredictable and subject to various external factors, it is essential to approach technical indicators like the Hindenburg Omen with a critical eye.

Conclusion

In conclusion, the Hindenburg Omen remains a mysterious and controversial indicator in the world of finance. While it has captured the attention of many investors, its true predictive power is still subject to debate. As with any trading strategy, due diligence, risk management, and a comprehensive understanding of market dynamics are crucial for making informed investment decisions. Whether you believe in the omen or not, it serves as a reminder of the complexities and uncertainties of the stock market.