Financials Begin to Outperform as Equity Go Trend Weakens

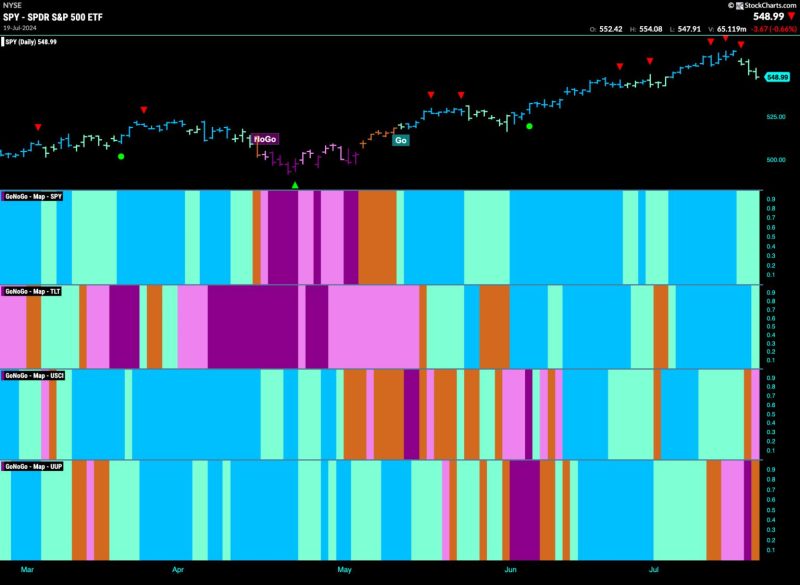

The past year has been a period of extensive market volatility, leaving many investors uncertain about where to position their assets for optimal returns. Amidst this uncertainty, a new trend has begun to emerge – financials are outperforming other sectors while equity markets weaken. This shift in performance has caught the attention of investors and analysts alike, prompting speculation about what lies ahead for these sectors.

One of the key factors driving the outperformance of financials is the gradual increase in interest rates. As central banks around the world signal a shift towards tighter monetary policy, financial institutions stand to benefit from higher interest margins. This trend has already started to manifest itself in the form of improved profitability for banks and financial service companies. Additionally, the uptick in interest rates has led to a resurgence in demand for financial products such as loans and mortgages, further boosting the sector’s performance.

Another factor contributing to the strength of financials is the improving economic outlook. As global economies continue to recover from the impact of the pandemic, businesses and consumers are becoming more optimistic about the future. This optimism is translating into increased spending, investment, and borrowing, all of which bode well for financial institutions. With a healthier economic backdrop, financials are expected to continue their outperformance in the coming months.

On the other hand, equity markets are beginning to show signs of weakness as valuations become stretched and inflationary pressures mount. Over the past year, stock prices have surged to new highs, driven in part by the influx of liquidity from central banks and fiscal stimulus measures. However, many market participants are now questioning whether these valuations are sustainable in the long run, especially as inflationary risks loom large.

Furthermore, rising inflation poses a threat to equity markets as it erodes the real value of future cash flows, making long-term assets such as stocks less attractive. Investors are beginning to shift their focus towards sectors that can better withstand inflationary pressures, such as commodities, real estate, and financials. This rotation out of equities and into inflation-resilient assets is expected to continue as inflationary expectations persist.

In conclusion, the financial sector’s outperformance amid weakening equity markets underscores the shifting dynamics of the investment landscape. As interest rates rise and the economic environment improves, financial institutions are well-positioned to benefit from these trends. Conversely, equity markets face challenges from stretched valuations and inflationary pressures, prompting investors to reconsider their asset allocations. By staying attuned to these developments, investors can navigate the evolving market conditions and position themselves for long-term success.