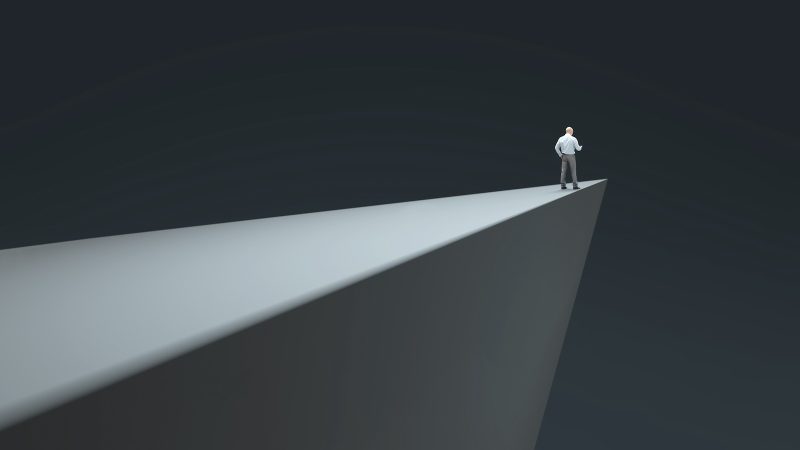

In the world of finance and trading, markets are continuously moving, responding to various factors such as economic data, geopolitical events, and company earnings reports. The NASDAQ, one of the major stock exchanges in the United States, has been an area of intense focus in recent times as it teeters on the edge of critical levels. Understanding these key levels is crucial for traders and investors looking to make informed decisions in the volatile landscape of the stock market.

1. Support Levels:

Support levels are areas on the chart where there is perceived buying interest that prevents the price from falling further. In the case of the NASDAQ, one significant support level to watch is around the 13,000 mark. This level has acted as a strong support in the past, providing a floor for the index during periods of selling pressure. If the NASDAQ breaches this level, it could signal further downside potential for the index.

2. Moving Averages:

Moving averages are technical indicators that help smooth out price data to identify trends more easily. The 50-day moving average is a commonly watched indicator that traders use to gauge the short-term trend of a stock or index. For the NASDAQ, the 50-day moving average can serve as a key level to monitor for potential shifts in momentum. If the index crosses below this moving average, it could indicate a weakening short-term trend.

3. Fibonacci Retracement Levels:

Fibonacci retracement levels are horizontal lines used to identify potential support and resistance levels based on the Fibonacci sequence. Traders often use these levels to determine areas of potential price reversal. For the NASDAQ, Fibonacci retracement levels can provide valuable insights into where the index may find support or face resistance. By studying these levels, traders can anticipate potential price movements and adjust their trading strategies accordingly.

4. Volume Analysis:

Volume is a critical factor in determining the strength of a price movement. High volume during a price advance or decline can signal increased conviction from market participants. By analyzing volume patterns, traders can assess the validity of price movements and identify potential turning points. For the NASDAQ, monitoring volume levels can provide clues about the sustainability of a trend and help traders make more informed decisions about their positions.

5. Relative Strength Index (RSI):

The Relative Strength Index is a momentum oscillator that measures the speed and change of price movements. Traders use the RSI to identify overbought or oversold conditions in a stock or index. When the RSI reaches extreme levels, it can suggest a potential reversal in price direction. For the NASDAQ, keeping an eye on the RSI can help traders anticipate when the index may be due for a pullback or continuation of a trend.

By closely monitoring these critical levels and technical indicators, traders can gain valuable insights into the current state of the NASDAQ and make more informed decisions about their trading strategies. While market movements are unpredictable, having a solid understanding of key levels can help traders navigate the volatile landscape of the stock market with more confidence and precision.