Market sentiment indicators are essential tools for investors to gauge the mood and emotions of market participants. By analyzing sentiment indicators, traders can get a sense of whether the market is overly optimistic or pessimistic, helping them make informed decisions. In the current market landscape, three key sentiment indicators have signaled a bearish phase, indicating a potential downturn in the near future.

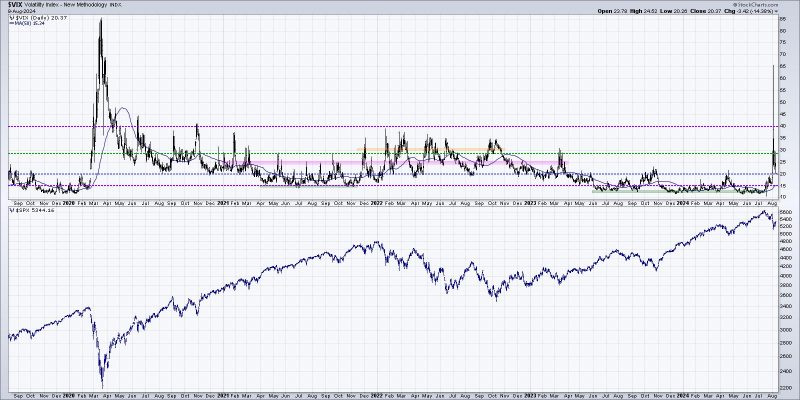

One of the first sentiment indicators pointing towards a bearish market outlook is the CBOE Volatility Index (VIX), commonly referred to as the fear gauge. The VIX measures market expectations of volatility over the next 30 days, with higher values reflecting increased fear and uncertainty among investors. During bearish phases, the VIX typically spikes as investors rush to hedge against potential market declines. A rising VIX suggests that market participants are uneasy about the future direction of the market, indicating a shift towards more cautious sentiment.

Another significant sentiment indicator signaling a bearish phase is the AAII Investor Sentiment Survey. This survey polls individual investors to determine their sentiment towards the stock market. When a majority of individual investors are bearish, it can be a contrarian indicator that the market is due for a bounce. However, when sentiment turns overwhelmingly bearish, it may indicate a more prolonged downturn. The recent data from the AAII survey has shown a notable increase in bearish sentiment, suggesting a growing pessimism among retail investors.

In addition to the VIX and the AAII Investor Sentiment Survey, the put/call ratio is another crucial indicator that can provide insight into market sentiment. The put/call ratio measures the volume of put options traded relative to call options, with high ratios signaling increasing concern or fear among investors. A high put/call ratio indicates a higher demand for put options, which are used to hedge against potential losses in the market. In recent weeks, the put/call ratio has been trending upwards, pointing towards a more bearish sentiment among options traders.

Overall, the convergence of these three key market sentiment indicators – the VIX, the AAII Investor Sentiment Survey, and the put/call ratio – paints a clear picture of a bearish phase in the market. While no indicator is foolproof, monitoring these sentiment indicators can provide valuable insights for investors looking to navigate uncertain market conditions. By staying informed and aware of changing market sentiment, traders can make better-informed decisions to protect their portfolios during bearish phases.