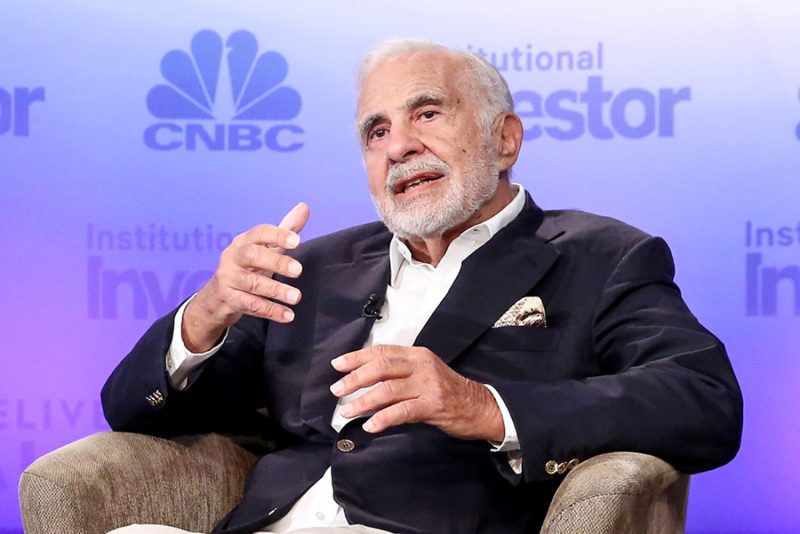

The Securities and Exchange Commission (SEC) has taken significant actions against billionaire investor Carl Icahn, accusing him of concealing billions of dollars’ worth of stock pledges. This has triggered a wave of discussions within the financial world as well as among Icahn’s followers and critics alike. The SEC’s move against such a prominent figure has raised questions about the transparency and disclosure practices of even the most esteemed investors in the industry.

Icahn’s reputation as an influential activist investor has long been established, with his investment decisions often having a substantial impact on the companies he targets. His ability to influence corporate management and strategies has made him a formidable player in the financial markets. However, the recent allegations brought by the SEC have cast a shadow over his business dealings and raised concerns about potential regulatory violations.

The SEC’s charges allege that Icahn failed to disclose crucial information about his stock pledges, which were used as collateral for margin loans. By not fully providing details about these pledges, Icahn may have misled investors and the public about the extent of his financial commitments and leveraging strategies. Transparency and full disclosure are fundamental principles in the financial markets, and any lapses in these areas can erode trust and confidence in the integrity of market participants.

The case against Icahn highlights the importance of regulatory oversight and enforcement in maintaining fair and orderly markets. The SEC plays a crucial role in protecting investors and ensuring compliance with securities laws, and cases like this serve as a reminder that even the most prominent figures in finance are not above the rules. By holding individuals and institutions accountable for their actions, regulators help uphold the integrity of the financial system and promote transparency and accountability.

It remains to be seen how Icahn will respond to the SEC’s charges and what impact this case will have on his reputation and investment decisions. The outcome of this legal battle could have far-reaching implications for the broader financial community and may prompt investors to reevaluate the risks associated with high-profile figures in the industry. As the case unfolds, market participants will be closely monitoring developments and assessing the implications for the broader investment landscape.

In conclusion, the SEC’s charges against Carl Icahn have sparked a contentious debate within the financial industry about the boundaries of regulatory compliance and the obligations of prominent investors to disclose their financial arrangements transparently. The outcome of this case will not only shape Icahn’s legacy but also serve as a significant test of the regulatory framework governing the financial markets. Transparency and accountability are fundamental principles that underpin investor trust and market integrity, and it is essential for all participants to adhere to these principles to maintain a fair and efficient financial system.