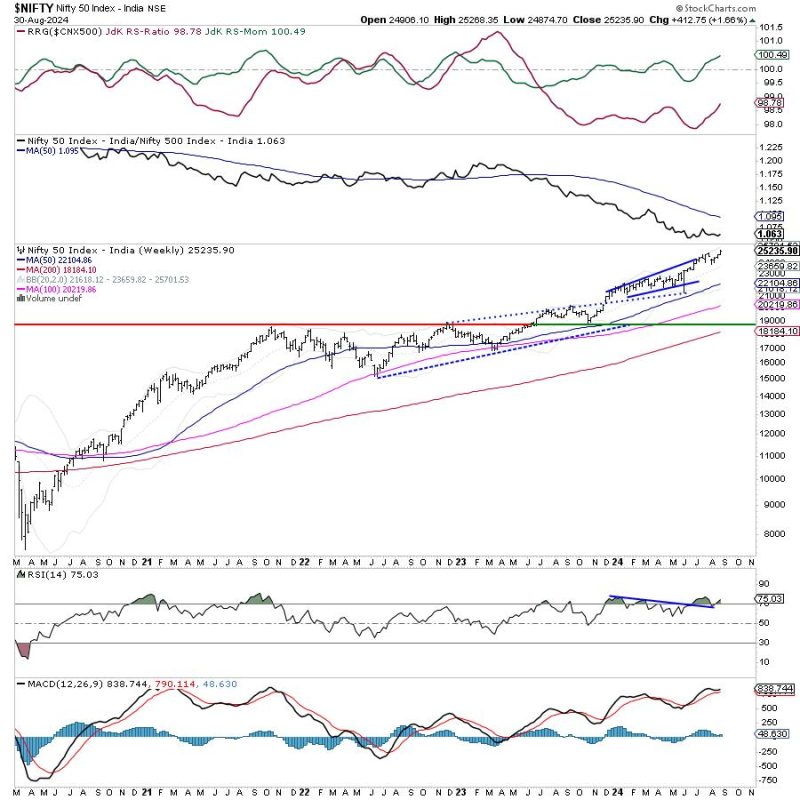

The Indian stock market has displayed resilience and a positive momentum in the recent weeks. The Nifty index has managed to maintain its uptrend trajectory, despite facing occasional challenges and volatility. As we look ahead into the coming week, it is crucial to assess the current market conditions and understand the possible trends that may influence investor sentiment.

One of the key tools used to analyze market trends and potential opportunities is the Relative Rotation Graphs (RRG). These graphs provide a visual representation of how different sectors and indices are performing relative to the benchmark index. In the current scenario, the RRG indicates a distinctly defensive setup, which suggests a shift towards sectors that are more resilient during uncertain times.

The defensive sectors, such as IT, FMCG, and Healthcare, have shown strength and stability, indicating a preference for safer investments among market participants. On the other hand, sectors like Metals, Banks, and Energy are displaying relative weakness, possibly due to external factors impacting their performance.

While the defensive setup of the RRG signals a cautious approach from investors, it is essential to note that market dynamics can change rapidly. External events, economic data releases, and global factors can all influence investor sentiment and market movements. Therefore, staying informed and adapting to changing market conditions is crucial for navigating the stock market successfully.

In addition to the RRG analysis, technical indicators and market sentiment can also provide valuable insights into the direction of the market. Traders and investors can use a combination of fundamental analysis and technical tools to make informed decisions and identify potential trading opportunities.

As the Nifty index continues to maintain its uptrend, it is important for investors to remain vigilant and monitor market developments closely. While the defensive setup on the RRG may suggest a degree of caution, it also presents opportunities for strategic investments in sectors that are better positioned to weather market uncertainties.

In conclusion, the Nifty index’s uptrend remains intact, but the market environment is evolving, requiring investors to adopt a flexible and proactive approach. By leveraging tools like RRG, technical analysis, and market sentiment indicators, investors can enhance their decision-making process and capitalize on emerging trends in the stock market.