Broad-Based Stock Market Selloff: How to Position Your Portfolio

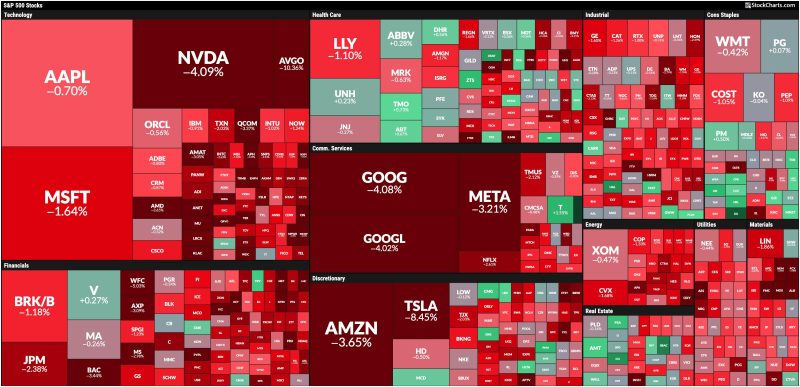

Market selloffs can be unnerving for investors, as they often result in significant declines in stock prices across various sectors. In times of broad-based selloffs, it is crucial for investors to reevaluate their portfolio positioning and make strategic decisions to navigate the turbulent market conditions.

1. Conduct a Portfolio Review

The first step in positioning your portfolio during a market selloff is to conduct a thorough review of your existing holdings. Evaluate the performance of individual stocks, funds, and other assets in your portfolio to identify areas of vulnerability. Consider factors such as sector exposure, company fundamentals, and valuation metrics to determine potential risks.

2. Diversification is Key

One of the most effective strategies to protect your portfolio during a market selloff is to ensure proper diversification. Diversifying your investments across different asset classes, sectors, and geographies can help reduce the overall risk exposure of your portfolio. Consider allocating a portion of your assets to defensive sectors such as utilities, consumer staples, and healthcare, which tend to be less volatile during market downturns.

3. Trim Overvalued Positions

During a market selloff, overvalued stocks are particularly vulnerable to sharp declines. Take this opportunity to reassess the valuation of your holdings and consider trimming positions that appear overvalued. Selling high-flying stocks with stretched valuations can help protect your portfolio from potential downside risks and free up capital for more attractively priced opportunities.

4. Consider Safe-Haven Assets

In times of market uncertainty, safe-haven assets such as gold, U.S. Treasury bonds, and cash equivalents can provide a defensive buffer against stock market volatility. Consider allocating a portion of your portfolio to these assets to reduce overall risk exposure and preserve capital during turbulent market conditions. Keep in mind that safe-haven assets may not generate high returns but can serve as a hedge against market downturns.

5. Stay Informed and Stay Calm

During a broad-based stock market selloff, it is crucial to stay informed about market developments and economic indicators. Monitor news headlines, earnings reports, and macroeconomic data to gain insights into potential market trends. However, it is equally important to remain calm and avoid impulsive decisions driven by fear or panic. Maintain a long-term perspective on your investment objectives and stick to your strategic asset allocation plan.

In conclusion, navigating a broad-based stock market selloff requires a disciplined approach and strategic decision-making. By conducting a portfolio review, diversifying your investments, trimming overvalued positions, considering safe-haven assets, and staying informed, you can position your portfolio to weather market downturns effectively. Remember that market selloffs are a normal part of the investing cycle, and staying patient and proactive can help you emerge stronger from challenging market conditions.