In the fast-paced world of finance, investors are constantly on the lookout for market-moving events that can influence their trading decisions. It’s crucial to stay abreast of the latest developments and put them into perspective to make informed decisions. Let’s take a closer look at how the Nifty index has been performing and the key factors that could impact its movements in the coming week.

1. **Current Market Analysis:**

The Nifty index has been exhibiting a mix of bullish and bearish sentiment recently, with fluctuations driven by various factors such as economic data releases, geopolitical events, and corporate earnings reports. It’s essential for investors to analyze the current market dynamics and understand the underlying forces driving the index’s movements.

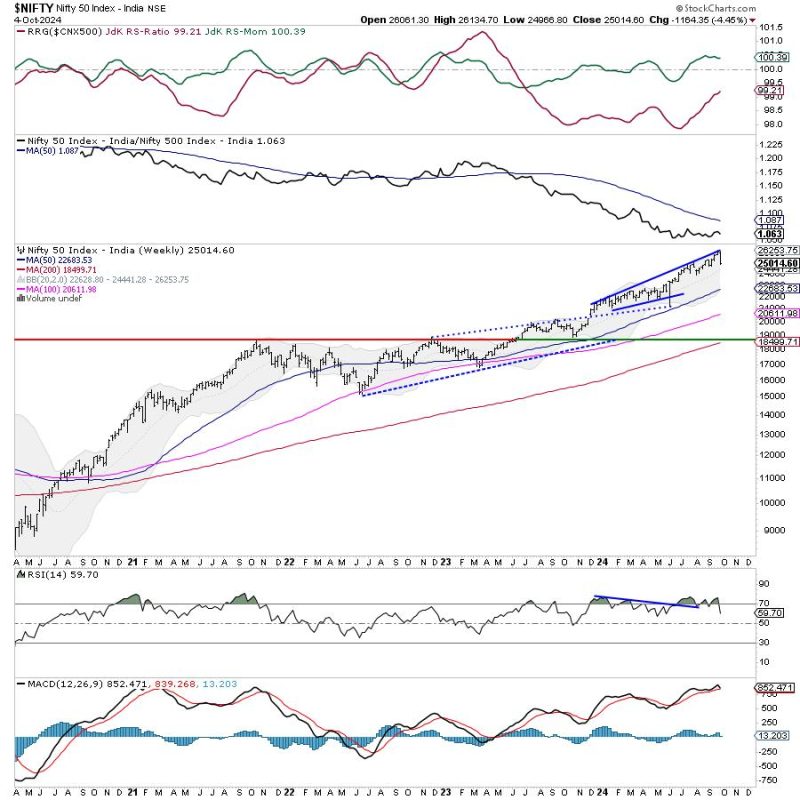

2. **Technical Analysis:**

Technical analysis plays a significant role in predicting future market trends based on historical price patterns and volume indicators. By examining key technical levels and chart patterns, investors can gain insights into potential support and resistance levels for the Nifty index, helping them make more informed trading decisions.

3. **Global Macro Trends:**

Global macroeconomic trends have a profound impact on financial markets, including the Nifty index. Factors such as changes in interest rates, geopolitical tensions, and global economic indicators can influence investor sentiment and drive market movements. Keeping a close watch on these trends is crucial for understanding the broader market context.

4. **Corporate Earnings Season:**

Corporate earnings reports can significantly impact stock prices and market sentiment. As companies release their quarterly financial results, investors closely monitor their performance and outlook to gauge the overall health of the economy and individual sectors. Positive earnings surprises can boost market confidence, while negative results may lead to sell-offs.

5. **Upcoming Events to Watch:**

In the coming week, investors should keep an eye on key events that could potentially move the Nifty index. These could include important economic data releases, policy announcements from central banks, geopolitical developments, and any unexpected news that could impact market sentiment. Being aware of these events and their potential implications is essential for making well-informed investment decisions.

6. **Risk Management Strategies:**

Given the inherent volatility of financial markets, it’s crucial for investors to implement effective risk management strategies to protect their capital and minimize losses. This could involve setting stop-loss orders, diversifying investment portfolios, and staying disciplined in sticking to a trading plan. By managing risk effectively, investors can navigate market uncertainties more confidently.

7. **Conclusion:**

As investors navigate the complex world of financial markets, staying informed and putting market moves into perspective is key to making successful trading decisions. By closely monitoring the Nifty index, analyzing market trends, and understanding the factors driving market movements, investors can position themselves strategically to seize opportunities and manage risks effectively in the dynamic landscape of finance.