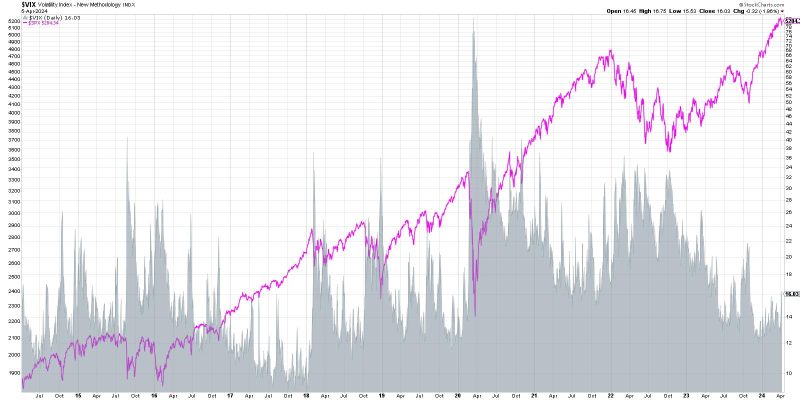

VIX Spikes Above 16 – Is This the End?

The recent surge in the VIX index, also known as the fear index, above the 16 level has sparked anxiety among investors and analysts alike. This sudden increase in volatility has raised concerns about the stability of the stock market and the potential for a significant downturn in the near future.

Many market watchers believe that a VIX level above 16 is a signal of increased market uncertainty and a higher likelihood of sharp market movements. The VIX index measures the market’s expectations for future volatility and is often used as a gauge of investor sentiment. When the VIX spikes above 16, it is typically interpreted as a sign that investors are bracing for turbulence ahead.

The recent spike in the VIX can be attributed to a variety of factors, including geopolitical tensions, economic data releases, and market uncertainties. The ongoing trade war between the United States and China, Brexit negotiations, and global economic slowdown concerns have all contributed to heightened market volatility.

Investors are closely monitoring the VIX levels and looking for clues about the future direction of the stock market. A sustained increase in the VIX above 16 could indicate a shift towards risk-off sentiment and a potential downturn in stock prices. While a higher VIX level does not necessarily guarantee a market crash, it does suggest that investors are becoming more cautious and are preparing for increased market fluctuations.

It is important for investors to remain vigilant during periods of elevated market volatility and to carefully assess their risk tolerance and investment strategies. Diversification and disciplined risk management are key principles to navigate through turbulent market conditions and protect investment portfolios from potential losses.

In conclusion, the recent spike in the VIX index above 16 has raised concerns about the stability of the stock market and the potential for increased volatility ahead. Investors should closely monitor VIX levels and market developments, stay informed about global economic and geopolitical events, and be prepared to adjust their investment strategies accordingly. While market uncertainty may persist in the short term, a prudent approach to risk management and portfolio diversification can help investors navigate through choppy waters and achieve their long-term financial goals.